Article de presse

Baromètre QIMA 2022 T1

BAROMÈTRE DU PREMIER TRIMESTRE 2022 : Examen de l'approvisionnement mondial pour 2021 : la fin est-elle en vue ?

Une année 2021 tumultueuse a vu des tendances de reprise prometteuses s'essouffler avec la résurgence des épidémies de COVID-19, la pénurie d'électricité en Chine et le chaos logistique persistant. Alors que de nombreux titres ont décrit les problèmes des chaînes d'approvisionnement comme un "cauchemar avant Noël", les données de QIMA pour 2021 suggèrent que les perturbations vont durer bien au-delà des fêtes de fin d'année.

Chine : Une reprise étouffée avec l'espoir d'une résilience en 2022

A l'instar de nombreux marchés de sourcing asiatiques en 2021, le sourcing chinois a connu un rebond impressionnant au cours du premier semestre, avant de s'essouffler à partir du troisième trimestre. Néanmoins, le géant de l'industrie manufacturière s'avère plus résistant que ses concurrents régionaux, la demande d'inspection et d'audit en 2021 augmentant respectivement de +21,5 % en glissement annuel et de +13 % par rapport à 2019.

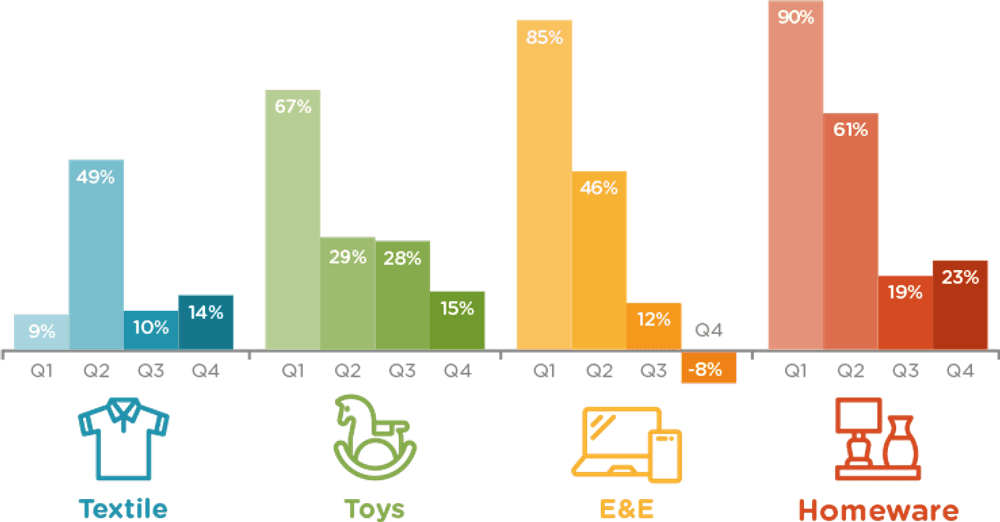

Après un premier semestre prometteur, le second semestre 2021 s'est avéré morose pour l'industrie manufacturière chinoise, la pénurie d'électricité de septembre ayant mis à mal les préparatifs de la haute saison des biens de consommation pour les fêtes de fin d'année . Toutefois, la demande d'inspections et d'audits en Chine a rebondi relativement rapidement dans la plupart des grandes catégories de biens de consommation, notamment le textile et l'habillement, les jouets et les articles ménagers. Une exception notable est l'industrie électronique et électrique, qui a vu la demande d'inspection et d'audit diminuer régulièrement depuis mai 2021, alors que de plus en plus de producteurs d'électronique subissaient le contrecoup de la pénurie mondiale de puces semi-conductrices.

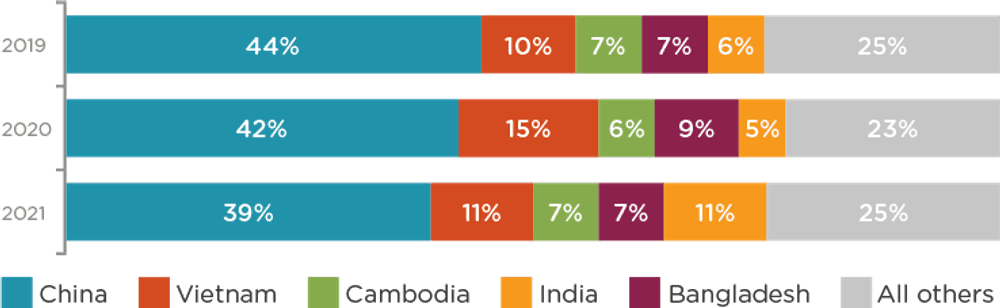

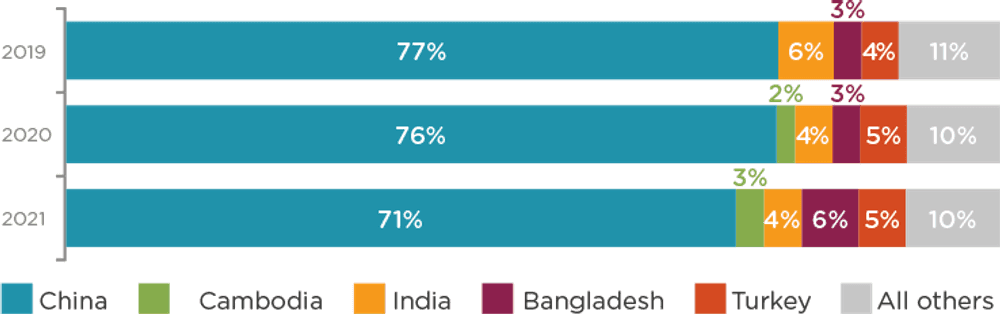

Les données du QIMA sur les inspections et les audits suggèrent que les acheteurs occidentaux sont restés prudents à l'égard de la Chine tout au long de l'année 2021. À défaut de retourner massivement en Chine, il semble que de nombreux acheteurs aient simplement maintenu leurs relations commerciales avec les fabricants chinois, comme en témoigne le fait que la part de la Chine parmi les cinq principales régions d'approvisionnement des acheteurs basés aux États-Unis et dans l'Union européenne en 2021 est restée à son niveau le plus bas depuis trois ans.

La tendance générale du sourcing en Chine en 2021 donne l'image d'une reprise post-pandémie qui, si elle n'a pas complètement déraillé, s'est certainement heurtée à quelques obstacles. En outre, les coupures d'électricité pourraient rester une menace dans les mois à venir, de même que d'éventuelles restrictions de fabrication dans le nord de la Chine en raison des prochains Jeux olympiques d'hiver à Pékin. Par conséquent, si l'optimisme est de mise pour le sourcing en Chine en 2022, il convient d'être prudent.

Fig. 1. Dynamique de croissance de l'inspection et de l'audit en Chine en glissement annuel pour 2021 (industries sélectionnées)

Fig. 2. Les 5 premières parts dans l'ensemble du sourcing (acheteurs américains)

Fig. 3. Les 5 premières parts dans l'ensemble de l'approvisionnement (acheteurs de l'UE)

Vietnam : L'ascension et le déclin d'une réussite en matière de récupération COVID

L'évolution en dents de scie de l'approvisionnement au Viêt Nam en 2021 met en évidence la volatilité persistante du paysage mondial de l'approvisionnement, et sert d'étude de cas sur les effets cumulés des perturbations liées aux pandémies.

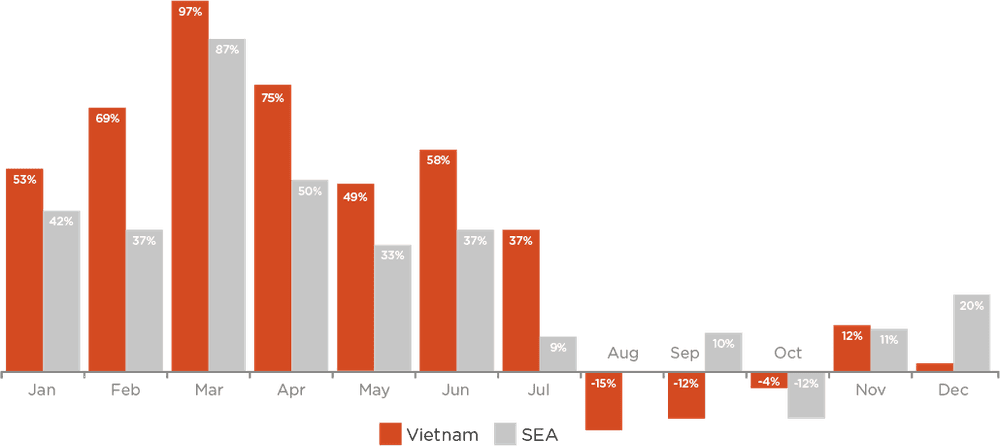

Au premier semestre 2021, le Vietnam a connu une poussée de croissance vigoureuse, alimentée par l'attention enthousiaste des acheteurs occidentaux qui affluent vers un marché d'approvisionnement familier avec un confinement réussi du virus. De janvier à juillet 2021, QIMA a enregistré une forte croissance à deux chiffres des volumes de demande d'inspection et d'audit par rapport à la période prépandémique de 2019, avec une expansion robuste de +67% en S1 2021 par rapport à S1 2019.

Cependant, l'arrivée de la variante Delta du COVID-19 à la fin du mois de juillet a provoqué un verrouillage qui a freiné la reprise au Viêt Nam, ce qui s'est traduit par trois mois consécutifs de baisse de la demande d'inspection et d'audit. Aujourd'hui, près d'un trimestre entier après la levée des mesures de confinement du virus en octobre, les dernières données montrent que l'industrie manufacturière vietnamienne a toujours du mal à se redresser. Les graves pénuries de main-d'œuvre en sont un facteur majeur : dès la levée du confinement, le personnel des usines a quitté les villes en masse, entraînant une pénurie de plus de 100 000 travailleurs dans le sud du Viêt Nam. Fin novembre, plus d'un tiers des usines vietnamiennes fonctionnaient à moins de 80 % de leur capacité et les commandes étaient retardées de plus de huit semaines.

Le secteur vietnamien de la chaussure et de l'habillement a été l'un des plus durement touchés par les fermetures et les pénuries de main-d'œuvre qui en ont découlé, la demande d'inspection et d'audit ayant chuté de 29 % en glissement annuel au quatrième trimestre.

À la suite de ce revirement spectaculaire, les inspections et les audits au Viêt Nam ont augmenté d'un maigre 3 % au cours de la deuxième moitié de l'année 2021 par rapport à la période prépandémique. La reprise au Viêt Nam devrait être progressive et se prolonger jusqu'en 2022.

Fig. 4. Croissance de l'inspection et de l'audit au Vietnam et en Asie du Sud-Est, 2021 vs 2019

Les régions de l'UE pratiquant la délocalisation bénéficient de la volonté des acheteurs de raccourcir les chaînes d'approvisionnement

La demande d'inspection et d'audit des marques de l'UE en Méditerranée et au Moyen-Orient est restée supérieure aux niveaux d'avant la pandémie pendant la majeure partie de 2021, la Tunisie, l'Égypte et la Jordanie bénéficiant d'un afflux de nouvelles commandes. La Turquie, dont le rebond manufacturier après les mesures de confinement du virus en 2020 a été largement couronné de succès, a vu la demande d'inspection et d'audit augmenter de +11,5% en 2021 par rapport à 2019 (+32% en glissement annuel).

Dans le même temps, la région de la Méditerranée et du Moyen-Orient dans son ensemble a connu une expansion impressionnante de +81% de la demande d'audit et d'inspection de la part des acheteurs de l'UE par rapport à 2019 (+40% en glissement annuel), car de plus en plus de marques ont déplacé leur fabrication plus près de chez elles, raccourcissant leurs chaînes d'approvisionnement afin d'éviter la forte augmentation des coûts d'expédition et, espérons-le, de minimiser les perturbations.

La reprise en Amérique latine et en Amérique du Sud est freinée par des goulets d'étranglement au niveau de l'offre et par le chaos logistique

La reprise post-pandémique dans les régions de délocalisation pour les acheteurs américains a été plus disparate, car les fabricants d'Amérique du Sud et d'Amérique latine continuent de lutter contre les défis cumulés de la pandémie et du chaos de la chaîne d'approvisionnement mondiale. La demande d'inspection et d'audit de la part des acheteurs américains au Mexique s'est contractée par rapport à 2019 pendant cinq mois consécutifs, les pénuries de matières premières et les problèmes logistiques entraînant des retards importants et une hausse des coûts de fabrication.

Inde : 2021 à emporter - Efforts de diversification des sources d'approvisionnement

Saluée par les experts comme un marché d'approvisionnement de plus en plus attractif pour de nombreuses catégories de produits, l'Inde est devenue l'alternative préférée de nombreux acheteurs américains à la Chine et à ses voisins en 2021.

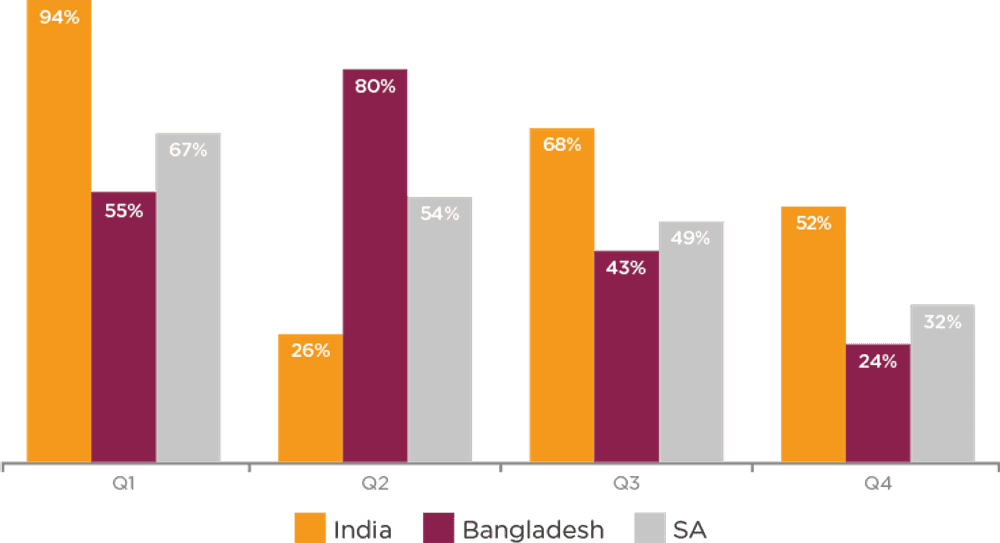

Alors que l'ensemble de la région Asie du Sud a connu une expansion à deux chiffres de la demande d'inspection et d'audit tout au long de 2021 par rapport à la période prépandémique, l'Inde est apparue comme un favori définitif, surpassant ses voisins et la région dans son ensemble au cours de tous les trimestres de 2021, à l'exception d'un seul. Une grande partie du succès de l'Inde peut être attribuée à l'intérêt croissant des marques basées aux États-Unis : la part de l'Inde parmi leurs 5 principales régions d'approvisionnement a presque doublé en 2021 par rapport à 2019.

En terminant l'année avec un pic impressionnant de +60% dans la demande d'inspection et d'audit par rapport à l'année 2019 pré-pandémique (+129% parmi les acheteurs basés aux États-Unis), l'Inde s'est avérée être un lieu d'approvisionnement inestimable pour de nombreux acheteurs au cours de l'année 2021. Reste à savoir si l'Inde, désormais confrontée à la nouvelle menace de la variante Omicron COVID-19, pourra maintenir sa série de victoires en 2022.

Fig. 5. Croissance de l'inspection et de l'audit en Asie du Sud, 2021 vs. 2019

Les perturbations à long terme de la chaîne d'approvisionnement s'avèrent désastreuses pour les droits de l'homme et la sécurité des travailleurs

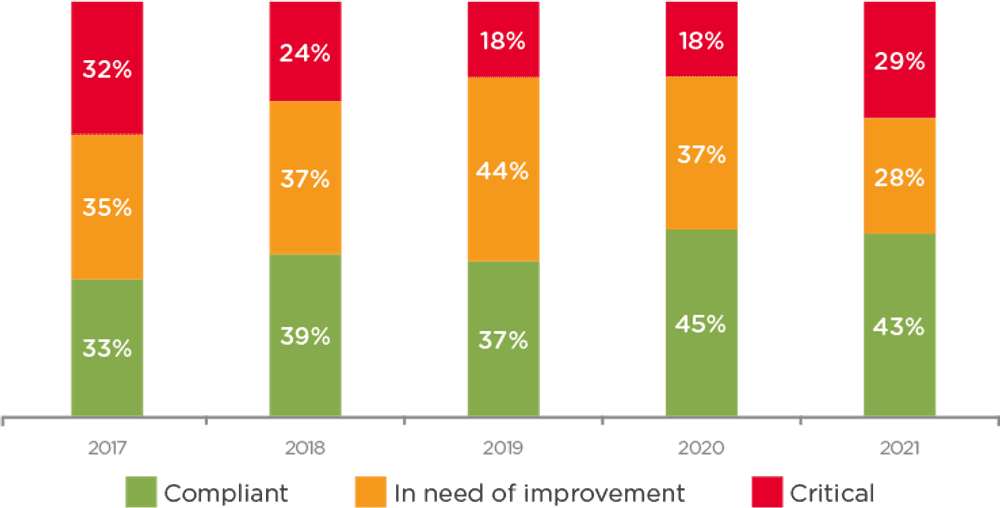

En 2021, la conformité éthique dans les chaînes d'approvisionnement mondiales s'est détériorée à un rythme alarmant, les données d'audit de la QIMA enregistrant les scores moyens des usines à leur plus bas niveau depuis quatre ans. Près d'un tiers (29 %) des usines auditées en 2021 ont été classées comme étant en situation de non-conformité critique et nécessitant une intervention immédiate, soit la proportion la plus élevée depuis 2017. Conformément aux défis posés par la pandémie, les violations ont été particulièrement nombreuses dans les domaines liés à la santé et à la sécurité (où les scores moyens en 2021 ont chuté de -7,5 % par rapport à 2020) et aux heures de travail et aux salaires (scores en baisse de -8 % par rapport à 2020).

Plus récemment, un rapport sur la chaîne d'approvisionnement a mis en évidence une forte augmentation des risques liés à l'esclavage moderne et aux droits de l'homme dans les régions d'approvisionnement, l'Asie du Sud-Est enregistrant la plus forte hausse des violations. Les données d'audit du QIMA montrent une détérioration des scores éthiques dans la région, le Myanmar étant l'un des plus mauvais élèves (scores éthiques en 2021 en baisse de -18 % par rapport aux moyennes de 2020).

Cette tendance, bien que décourageante, n'est pas surprenante, car les années passées ont montré de nombreux exemples de droits de l'homme et de respect de l'éthique qui ont été laissés de côté, les entreprises étant forcées de fonctionner en mode de survie et de donner la priorité aux questions de coûts.

Fig. 6. Évolution des classements éthiques des usines, 2017-2021

Perspectives 2022 : Renforcer l'agilité et la résilience de la chaîne d'approvisionnement

Malgré les nombreux espoirs placés en 2021, cette année n'a pas été celle de la reprise et du retour à la normale avant la pandémie. Entre les nouvelles variantes du COVID-19, la vaccination disproportionnée dans les différentes régions d'approvisionnement et les différentes approches de l'endiguement du virus, l'impact de la pandémie sur les chaînes d'approvisionnement mondiales reste important. Associé aux pénuries de matières premières, aux obstacles logistiques et à l'escalade rapide des risques éthiques, le paysage de l'approvisionnement mondial devrait rester instable en 2022 - et le traverser avec succès nécessitera un tout nouveau degré d'agilité et de résilience de la chaîne d'approvisionnement.

Contact presse

Courriel : press@qima.com